The Year in Review: Remote deposit Capture 2017

January 04, 2018

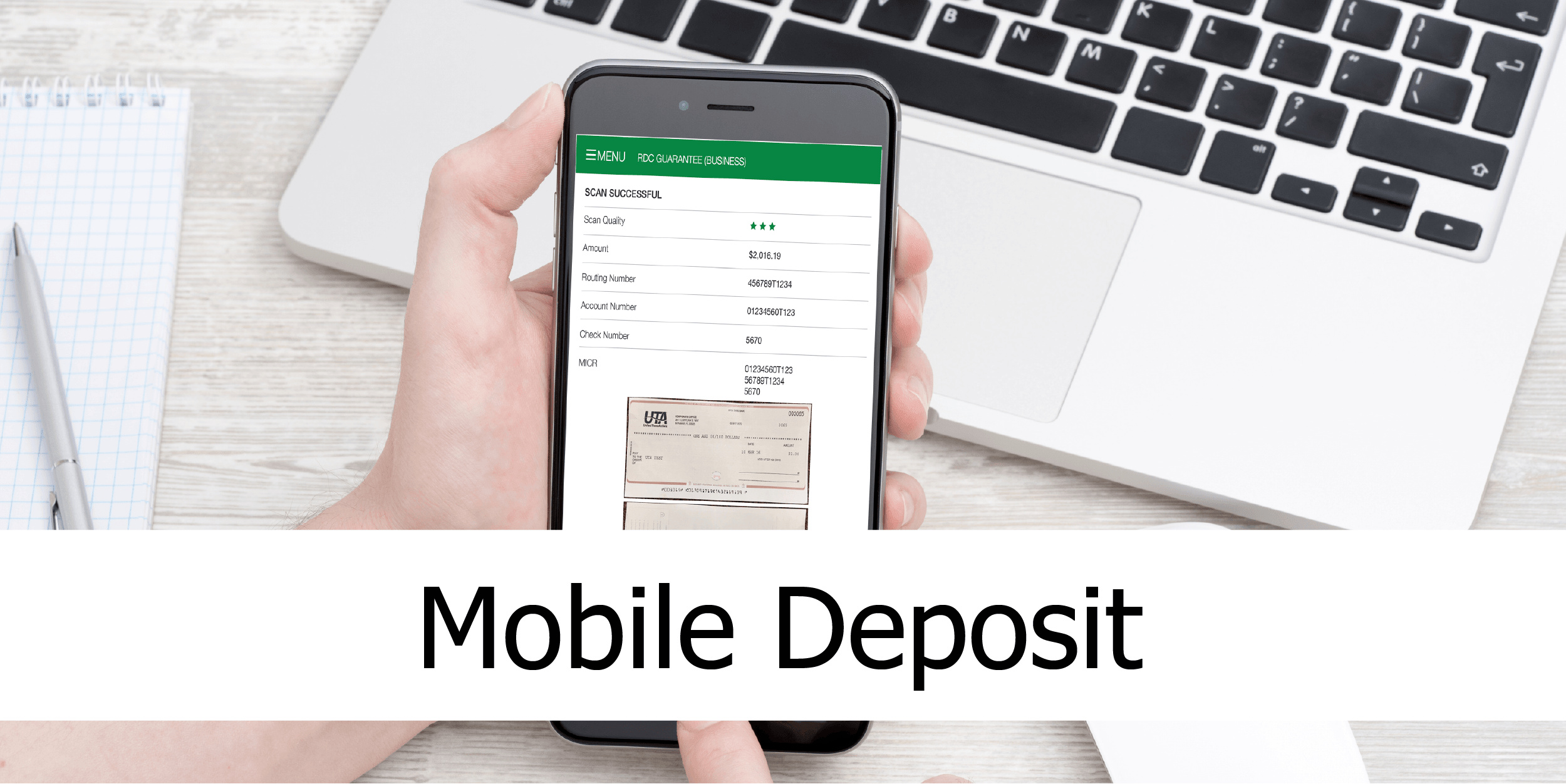

2017 was an eventful year for the remote deposit capture industry. We had new regulations, introductions of new services and enhancements of current capabilities, industry reports from the Federal Reserve, to the evolving risk landscape and mass adoption of mobile RDC, this industry has continued to grow and evolve.

2017 was an eventful year for the remote deposit capture industry. We had new regulations, introductions of new services and enhancements of current capabilities, industry reports from the Federal Reserve, to the evolving risk landscape and mass adoption of mobile RDC, this industry has continued to grow and evolve.Remote deposit capture is not only the simple process of capturing an image of a check, it also involves data capture, validation, integration, reporting and more. The paper check plays a critical role for us.

However, the notion that checks are a thing of the past continues to be challenged, even though there has been several initiatives to move check payments to electronic alternatives, according to the Federal Reserve the decline in check writing that began in the mid-1990s is abating. Total checks written fell 4.8% per year between 2012 and 2015, according to the Federal Reserve Payment Study 2016, compared to 6.2% per year more than a decade previously.

The value that RDC presents to financial institutions and their customers continues to grow. Earlier on 2017, Celent, estimated that all but a few thousand of the smallest banks and credit unions offer mobile RDC to consumer customers.

One sign of this growth potential in the evolution of RDC has been a vendor focus on intelligent scanners that rely on Internet connectivity and support more robust routines.Remote Deposit Capture exanimated this trend and highlighted FI and client considerations for evaluating RDC hardware in this new environment.

Source: Remote Deposit Capture.