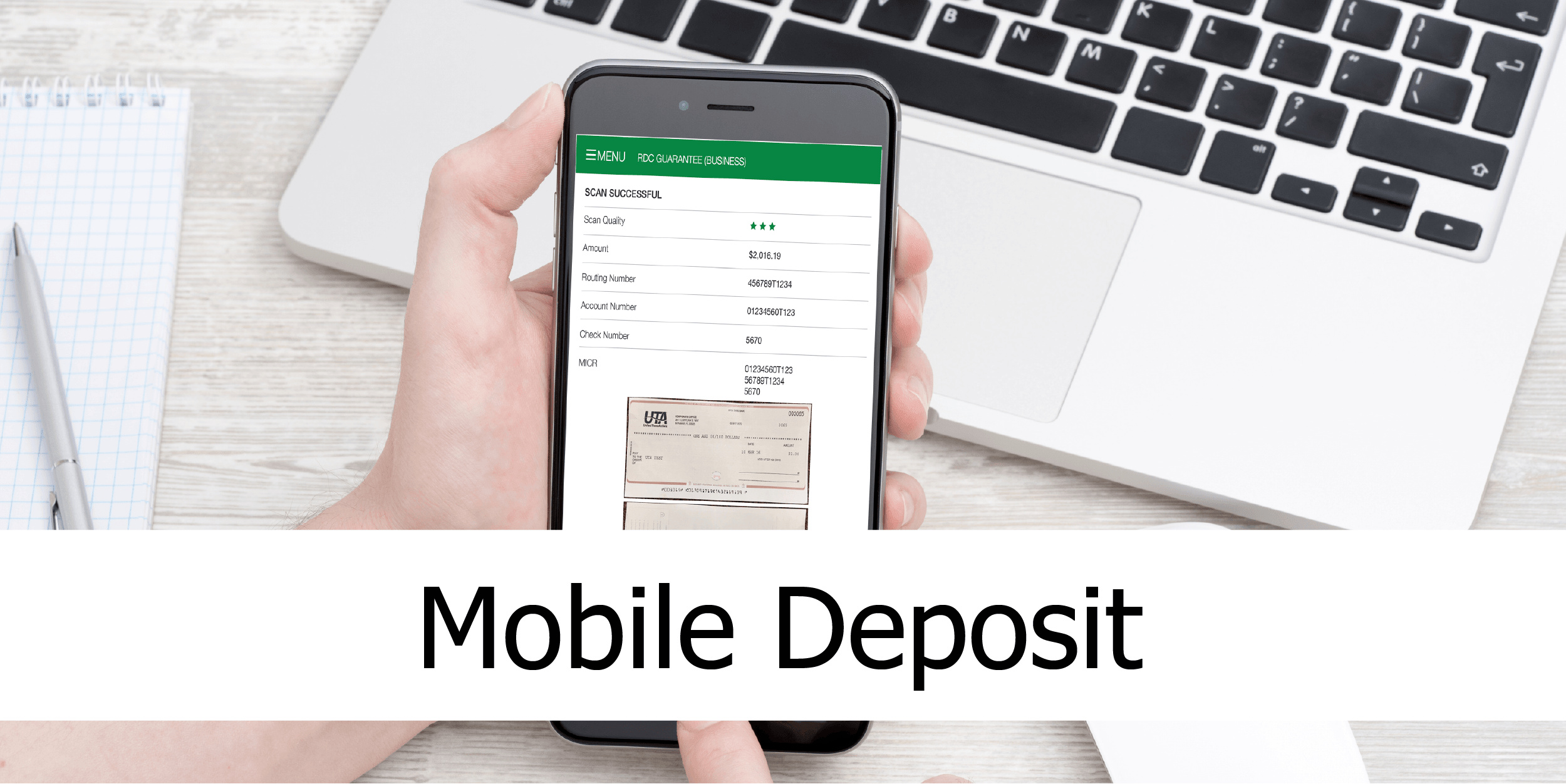

Mobile Deposit grew 35% in 2017, at community banks and Credit Unions

January 22, 2018

According to a software firm, in 2017 mobile remote deposit capture transactions jumped 35% over the previous year thanks to an increase in users.

According to a software firm, in 2017 mobile remote deposit capture transactions jumped 35% over the previous year thanks to an increase in users.“For banks and credit unions live for all of 2017, mobile deposits grew by an average of 35%,” Austin, Texas-based Malauzai Software Inc. said Wednesday in its latest “Monkey Insights” report. “Key metrics such as average value ($525) and number of deposits per month (2.6) stayed constant so the growth was in number of users. More people are using mobile banking to deposit checks.”

The report was created with the data from December 2017 from 400 financial institutions covering 17 million logins from 885,000 active online and mobile banking users.

According to Malauzai, 2.5% of the deposits came in through desktop computers. Apple Inc.’s Iphone dominates mobile banking, with a 35% of active users last year versus 25% increase for users with smart phones running Alplabet Inc’s Android.

Source: Digital Transactions.