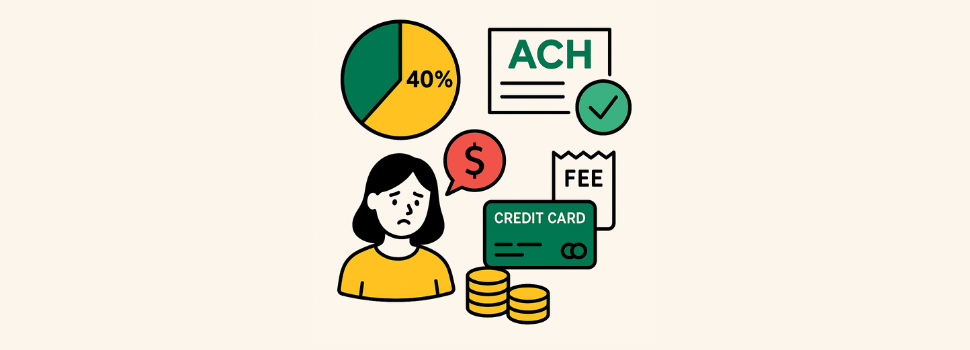

Merchants Are Seeing 40% of Payments Shift to ACH When Applying Credit Card Surcharges

June 30, 2025

Merchants today face rising payment processing costs, especially when accepting credit cards. Many have started to pass these costs on to customers by adding a surcharge for credit card transactions. But what happens when customers incur this extra fee?

A growing trend shows that about 40% of payments convert to ACH or electronic checks when a surcharge is applied. Here’s why this shift is happening, and what it means for your business.

Customers React to Surcharge Fees

When a business adds a surcharge fee to credit card transactions, it’s intended to recover the cost of accepting credit cards, which can reach up to 3%. While this helps the business, customers often don’t want to pay more.

Instead of using a credit card, many customers seek alternative payment methods that avoid extra costs. ACH payments (also known as electronic checks) offer them a fee-free option, leading to a natural shift away from credit cards.

ACH: A Simple, Cost-Effective Option

ACH payments allow businesses to transfer funds directly from a customer’s bank account using routing and account numbers. ACH processing has several advantages:

-Lower fees: ACH processing fees are typically 70% to 80% lower than credit card fees.

-No chargebacks: Unlike credit cards, ACH (with guarantee) transactions don’t involve chargebacks for disputes.

-No returns: When combined with a guarantee, ACH payments can help avoid returns due to insufficient funds or fraud.

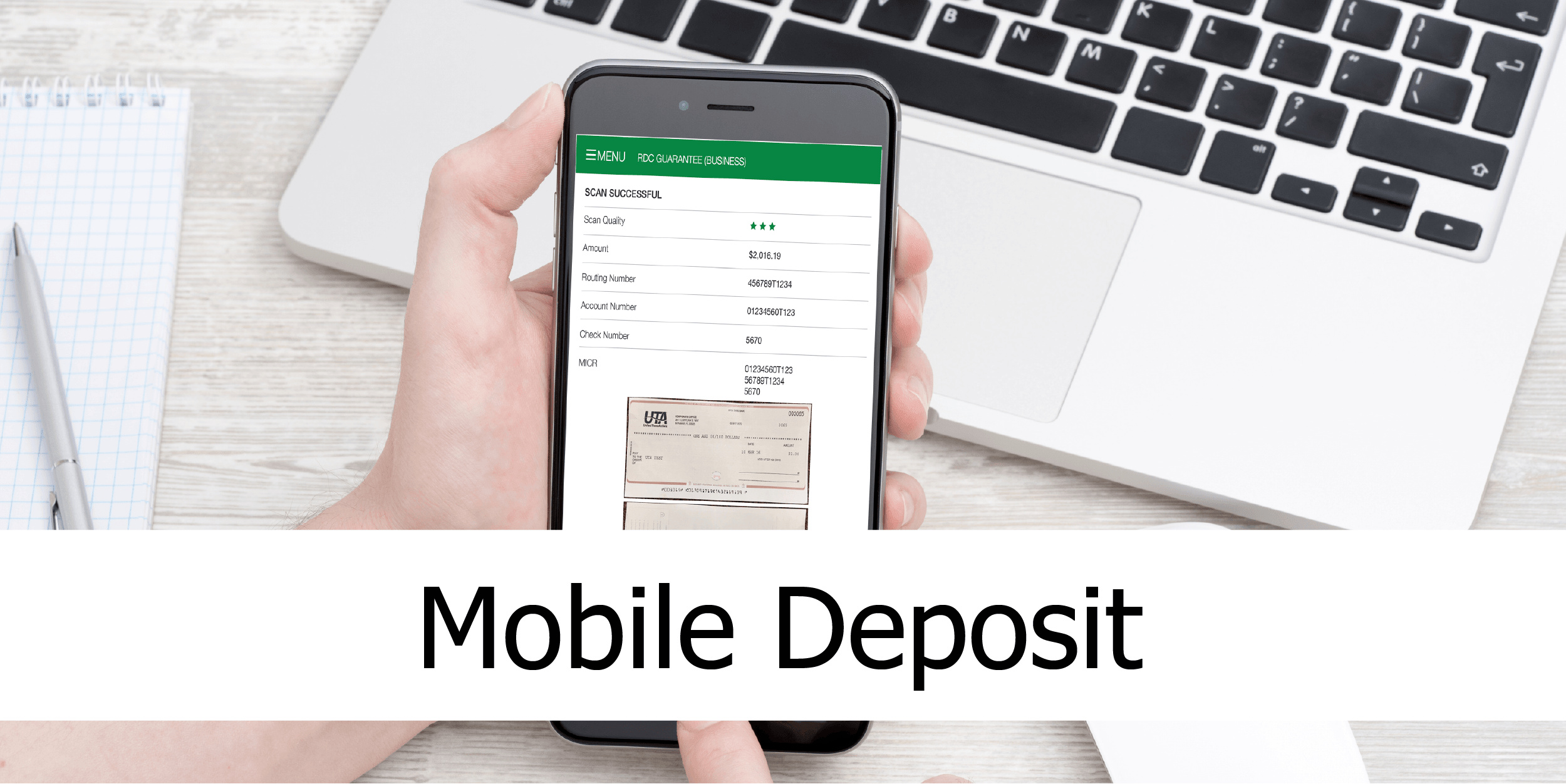

-Faster funding: Our ACH program offers next-day funding, improving cash flow.

The 40% Conversion Effect

Once surcharges are introduced, about four out of every ten merchants switch to ACH. This isn’t just a cost-saving move for them, it’s also an opportunity for businesses to save on processing costs.

By encouraging ACH payments, businesses can:

-Improve the customer experience.

-Speed up settlement times.

-Strengthen cash flow and operational predictability.

Making ACH Easy: The UTA ACH Solution

At United TranzActions (UTA), we make it simple for businesses to offer ACH as a strong alternative to credit cards.

Our Electronic Check / ACH Processing with Guaranteed Settlement gives you:

-Immediate approval or decline decisions.

-Next-day funding.

-Zero chargebacks.

-No returns for NSF, fraud, or other reasons.

-Significantly lower processing fees than credit cards.

If your business is considering applying surcharge fees when accepting credit card payments, it’s essential to be prepared for the change. About 40% of customers are likely to choose ACH instead, and that’s a good thing when you have the right solution in place.

Mark Tapia

Vice President Business Development

mtapia@unitedtranzactions.com

800.858.5256 ext 3028.

Direct: 786.264.7028.